Americans Are Giving Made-in-China the Cold Shoulder

May 17, 2020By Brendan Murray May 17, 2020, 8:00 PM GMT+8

New poll shows 40% won’t buy Made-in-China products

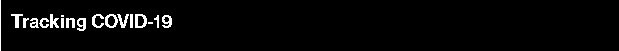

Supply Lines is a daily newsletter that tracks COVID-19’s impact on trade. Sign up here, and subscribe to our Covid-19 podcast for the latest news and analysis on the pandemic.

It’s not quite a new Cold War yet. Just the cold shoulder.

Some 40% of Americans said they won’t buy products from China, according to a survey of 1,012 adults conducted May 12-14 by Washington-based FTI Consulting, a business advisory firm.

That compares with 22% who say they won’t buy from India, 17% who refuse to purchase from Mexico and 12% who boycott goods from Europe.

The poll also found:

- 55% don’t think China can be trusted to follow through on its trade-deal commitments signed in January to buy more U.S. products

- 78% percent said they’d be willing to pay more for products if the company that made them moved manufacturing out of China

- 66% said they favor raising import restrictions over the pursuit of free-trade deals as a better way to boost the U.S. economy

For observers of trade policy, that last point is striking because a large majority in the U.S. have traditionally shunned protectionism. According to Gallup, almost four-fifths of Americans embrace international commerce as an opportunity rather that a threat, a number that’s steadily risen over the past decade.

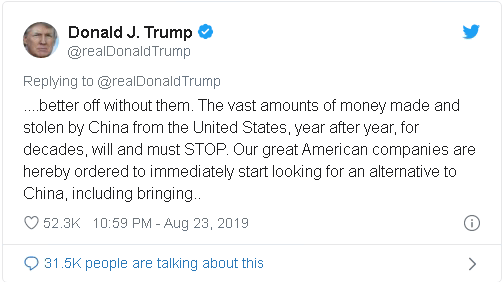

After two years of tariff wars and now the scourge of a coronavirus that originated in China, it’s hardly surprising to see some souring of U.S. public opinion about the country’s main economic rival. But the degree of the shift and the timing of it — less than six months before a presidential election — may mark a sea change in the electorate. It could embolden some of China’s harsher critics in Washington, with huge potential consequences for financial markets.

“Foreigners are an all too easy political target in normal times. But once they become unpopular, politics can turn dangerous, as they turn into policy,” said Chad Bown, a trade expert at the Peterson Institute for International Economics. “As candidates compete over who can adopt a more extreme stance toward China between now and November, their post-election policies toward Beijing are increasingly being set in stone.”

President Donald Trump drove the wedge a little deeper last week when he suggested in an interview on Fox Business Network that the U.S. could sever ties entirely. “There are many things we could do — we could cut off the whole relationship,” Trump said when asked about taking punitive steps like reducing U.S. visas for Chinese students.

Beijing’s response on Friday showed little effort to win a likability contest. “Such lunacy is a clear byproduct, first and foremost, of the proverbial anxiety that the U.S. has suffered from since China began its global ascension,” according to an editorial in the Global Times, a Chinese tabloid run by the flagship newspaper of the Communist Party.

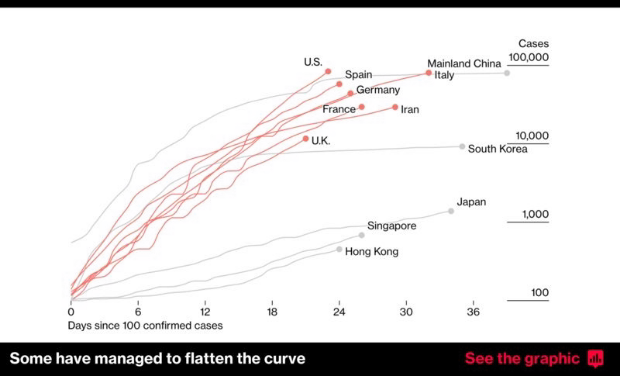

Trump’s divorce threat revived memories of his tweet last August when, in the heat of the trade war, he “hereby ordered” American companies to look for alternatives, saying “we don’t need China and, frankly, would be far better off without them.” He called on executives to bring jobs home and make products in the U.S. — repeating his argument for a decoupling from China that the pandemic has only amplified.

FTI’s survey from last week showed 86% of respondents say the U.S. relies too heavily on foreign supply chains.

For a majority of U.S. companies that do business in China, uprooting themselves from world's second-largest economy isn’t really feasible. But according to a March survey of members of the American Chamber of Commerce in China, 44% of respondents said it’s not possible for the two economies to decouple, down from 66% polled in October. A fifth said decoupling will accelerate.

For U.S. consumers, who may not fully grasp how much they consume from China, the desire for a breakup is intensifying. According to Kat Devlin, a research associate at the Pew Research Center’s Global Attitudes Project, “we’re in somewhat uncharted territory with how Americans see China.”

A Pew poll taken in March showed 66% of U.S. adults held China in an unfavorable light — a record high in Pew surveys going back to 2005 and up almost 20 percentage points since Trump took office in January 2017. The survey didn’t explicitly ask about the coronavirus. It measured favorable views at 26%, down from 44% three years ago.

That’s an unusually abrupt turn because it takes a lot to sway American opinion about foreign powers.

Favorable sentiment toward the European Union, for example, has held fairly steady around 50% since 2002, Devlin says. Positive views on Russia, on the other hand, fell from 44% in 2007 to 18% last year — a drop Devlin says became noticeable after Russia’s actions in Crimea.

Gallup polling published in 2018 showed favorable ratings for Japan peaking at 87%, recovering from lows set two decades earlier. That same report showed favorable views on China’s surpassing 50% for the first time since early 1989 — an upswing that's since been reversed.

“China’s diminished views in recent years is an interesting example because, while views tended to fluctuate somewhat, they historically stayed within a set range,” Devlin said. “While negative views did increase amid the U.S.-Japan trade wars of the 1990s, it never peaked as dramatically as we’re seeing with China today.”

Source:https://www.bloomberg.com/

Comment(s)